does texas have inheritance tax 2021

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. Tennessee had a separate inheritance tax which was phased out as of january 1 2016.

Texas Inheritance And Estate Taxes Ibekwe Law

Final individual federal and state income tax returns.

. For deaths that occur. There are no inheritance or estate taxes in Texas. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate.

Prior taxable years not applicable. The state of Texas is not one of these states. The federal government of the United States does have an estate tax.

As noted only the wealthiest estates are subject to this tax. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned property in Iowa Kentucky Maryland Nebraska New Jersey or. Citizen may exempt this amount from estate taxation on assets in their taxable estate.

Elimination of estate taxes and returns. The state of Texas does not have any inheritance of estate taxes. For 2020 and 2021 the top estate-tax rate is 40.

Texas does not have state estate taxes but Texas is subject to federal estate taxes. The estate tax starts at 18 and goes up to 40 for those anything over the 234 million threshold. A handful of states that have relatively high income tax rates or high overall tax burdens saw a flood of residents picking up stakes and moving in.

In 2020 the exemption was 1158 million per individual 2316 million per married couple. However this is only levied against estates worth more than 117 million. A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the state.

Someone will likely have to file some taxes on your behalf after your death though including the following. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The Texas Franchise Tax.

The rate increases to 075 for other non-exempt businesses. B Tax penalty and interest liabilities and refund eligibility for prior taxable years shall not be affected by the enactment of this Code section and shall continue to be governed. As of 2019 only twelve states collect an inheritance tax.

You might owe money to the federal government though. What Is the Estate Tax. For example if you made gifts of assets during your lifetime valued at 6 million and you owned assets valued at 8 million at the time of your death your estate would be subject to federal gift and estate taxes for the combined value of 14 million at a tax rate of 40 percent.

It is one of 38 states with no estate tax. The estate tax exemption in 2021 is 11700000. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

So only very large estates would ever need to worry about this tax becoming an issue. Each are due by the tax day of the year following the individuals death. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Does texas have an inheritance tax 2019. TAX RATE B TAX RATE E. With proper tax planning and estate planning you have the ability to pass an estate much larger than this without being subject to the federal estate tax.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The estate tax exemption is 234 million per couple in 2021. The state of texas does not have an inheritance tax.

There is a 40 percent federal tax however on estates over 534 million in value. Texas does not levy an estate tax. There is no federal inheritance tax but there is a federal estate tax.

Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023. Do you have to pay estate tax in Texas.

Recently the estate tax law was changed so that a decedents estate tax exemption may be applied against lifetime gifts and after-death bequests by will or trust. The tax rates listed below have already been reduced by the applicable rate reduction for decedents dying on or after January 1 2021 but before January 1 2022 and should be used in the computation of shares for each beneficiary of the inheritance tax owed. The state repealed the inheritance tax beginning on September 1 2015.

Most of its laws surrounding inheritance are straightforward. The final federal and state tax returns as well as the federal estatetrust income tax return are all due by tax day of the year following your death. Ultimate Texas Probate Guide Probate Process 2021 Property owned jointly between spouses is exempt from inheritance tax.

The exemption increases with inflation. An inflation adjustment increased this amount to 117 million per person and 234 million per couple. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

The state of Texas does not have an inheritance tax. The federal estate tax is a tax on property cash real estate stock or other assets transferred from deceased persons to their heirs. Regardless of the size of your estate you wont owe estate taxes to the state of Texas.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. These federal estate taxes are paid by the estate itself.

Estate tax is only levied on property that exceeds 549 million per person which means that estate tax for a couple is 1098 million. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. That said you will likely have to file some taxes on behalf of the deceased including.

Does texas have an inheritance tax in 2020. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Texas Residents Need To Know About Federal Capital Gains Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Best States And Towns For Retirement 2021 Tennessee And Texas Advance Topretirements

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Make Texas Your Permanent Domicile For Estate Planning Purposes Houston Estate Planning And Elder Law Attorney Blog August 19 2021

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Texas Lady Bird Deed Form Get A Ladybird Deed Online

Inheritance Tax Tax Fans Allen

States With No Estate Tax Or Inheritance Tax Plan Where You Die

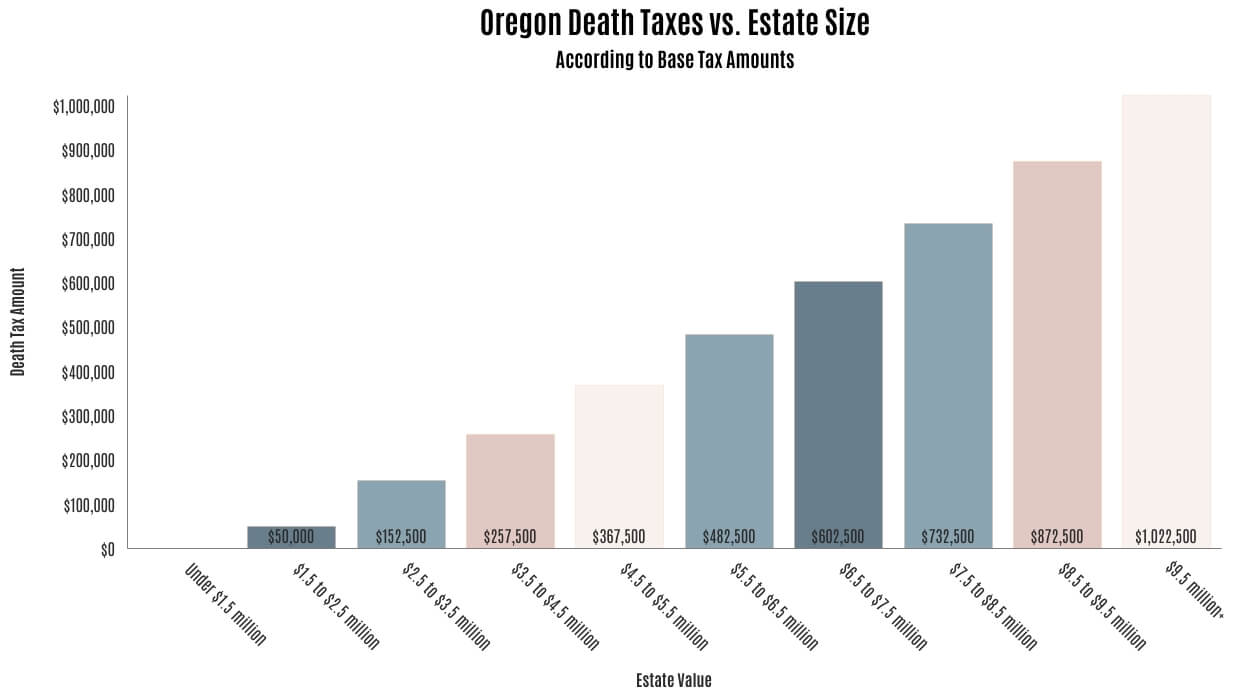

Death Taxes In Central Oregon De Alicante Law Group

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

2 Texas Cities Make Forbes List Of Best Places To Retire In 2021

Talking Taxes Estate Tax Texas Agriculture Law

Death And Selling Property Texas National Title

Death And Selling Property Texas National Title